Cost,Volume and Profit Analysis is a system which under specific suppositions helps the arrangement creator to figure future deals, dream certain benefit, denounce a security circumstance and the check the altered cost scope assets. Under CVP investigation taking after things is processed with significant need.

Commitment Margin

• Break-even point

• Margin of Safety

• Sensitivity Analysis

• Sales Mix Analysis

2.1.1.1 Contribution Margin

Commitment Margin implies net of variable expenses from deals income which takes care of the altered expenses. It is the sum staying after the finding of variable cost and continues recovering the settled costs. Variable expense is the costs related with creation and deals units where altered expenses are the costs not related with the units sold and can likewise

be termed as the costs brought about in the foundation time of the association. Thus, the sum after variable expenses are acknowledged from deals income requires to cover the settled costs.

Typically,

Commitment Margin = Sales-Variable Costs

2.1.1.2 Break Even Point

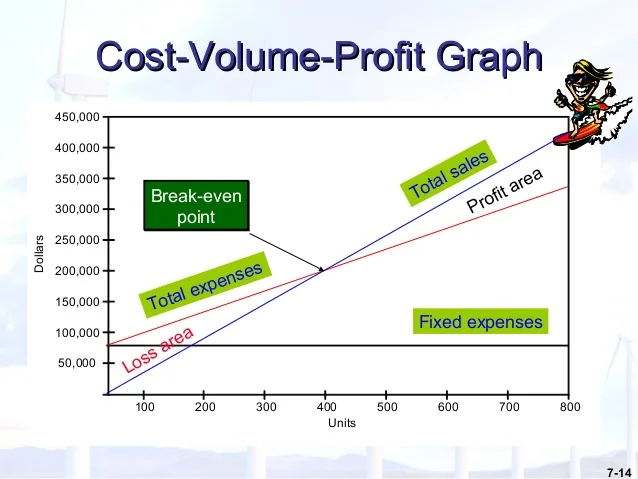

Make back the initial investment Point is the period where the association will be in no benefit no misfortune circumstance. It can likewise be reviewed as a position where slight changes in deals additionally brings about greatest benefit. Costs equivalents to Revenue can likewise be termed as a make back the initial investment point. Till Break-even point, an association has as of now endured each misfortunes and expansion in deals will actuate benefit.

2.1.1.3 Margin of Safety

Edge of security is the protected period where the association has been gaining deals income surpassing the earn back the original investment point. Under this circumstance each business return certain benefit, so this period is termed as Margin of Safety.

Typically,

Edge of Safety (MOS) = Actual Sales-Break Even Sales

2.1.1.4 Sensitivity Analysis

CVP examination alike from various suspicions depends on particular estimation of the considerable number of variables utilized as a part of the investigation. Since these variables are once in a while known with assurance, it is useful to run a CVP investigation commonly with various blends of assessments.

2.1.1.5 Sales Mix Analysis

Deals Mix Analysis is a connection when any association deals more than an item. Deals Mix Analysis is a similar connection of the multi item's offering cost. Under deals blend investigation offering cost of various item are thought about and weighted normal offering cost is figured for further CVP Analysis strategy.

No comments:

Post a Comment